In an attempt to address the housing supply issues, particularly in regional areas of NSW, the Labor Government has announced a $30 million commitment to the “build to rent” scheme.

This scheme aims to provide longer term rentals in the housing market to ease the pressures on housing supply as well as boost the economy through building and construction jobs in regional towns.

What is the “build to rent” program being introduced to regional areas of NSW?

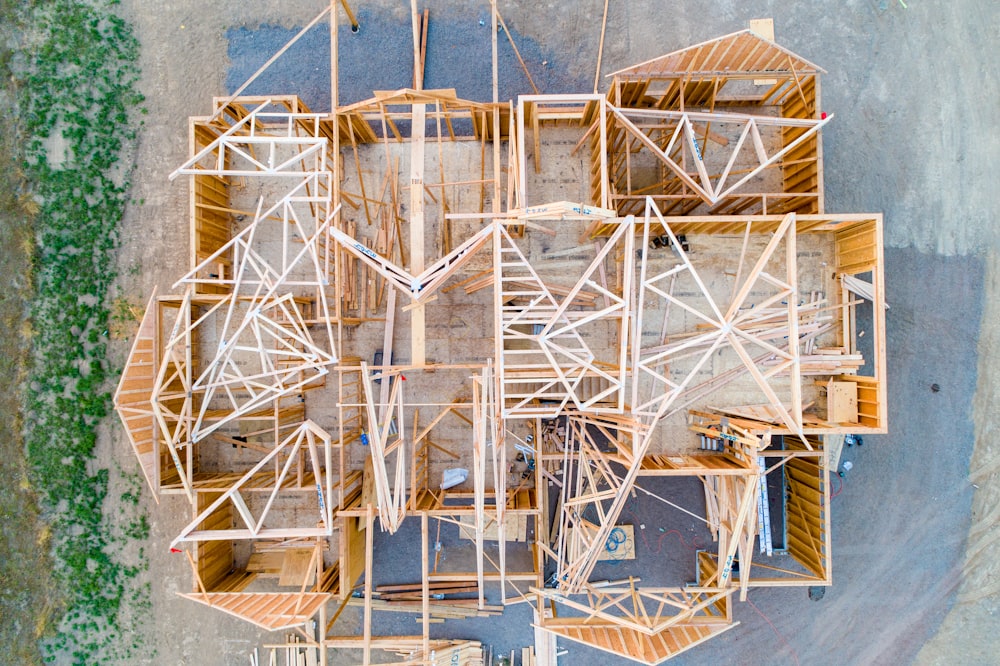

The Build-to-rent housing program is a Government incentivised development of large-scale residential properties, with purpose-built rental accommodation where all the properties are owned and managed by a single entity and are rented out over mid to long-term periods, with some rental contracts could be up to 3 years.

Build-to-rent housing will increase the supply of rental accommodation and provide more options for prospective tenants as well as boost building and construction jobs in the regional areas to drive the economic recovery.

With a larger supply of rental properties available, this can alleviate the upward pressure on prices in the existing rental market and ease cost of living pressures in the local community.

Who is building “rent to buy” properties?

The build to rent model could be favoured by private real estate funds, developers and superannuation funds and it is smaller private investors familiar with residential development and larger listed entities who are developing build-to-rents in Australia, with the “brand” of developments set to become a selling point.

How are the ‘build to rent’ properties different to regular investor owned properties?

The developers of ‘build-to-rent’ projects focus on shared facilities, shared services, and communal spaces like swimming pools, gyms, gardens, and sometimes on-site café’s. These types of properties are considered social spaces and because of all the available facilities the rent is often priced higher than regular properties on the rental market. For the tenants, they will enjoy premium facilities and may also enjoy the security of a longer-term lease alongside the convenience of on-site management.

Regular apartment blocks are usually designed and built with a view to maximising sales of the individual apartments; whereas with build-to-rent, the project is based on maximising residents’ enjoyment and liveability.

Will the “built to rent” properties provide affordable accommodation solutions?

One of the main issues with this type of scheme, is that the accommodation doesn’t always provide a more affordable solution but rather introduces a new type of property onto the rental market often with higher rental prices because of the premium facilities in the building. To combat this, it is a requirement for the developers to set aside a minimum of 30% of all the new homes built under the ‘Build to Rent’ program for social, affordable and universal housing.

This scheme might also assist indirectly with rental prices by offering more stock on the market, putting downward pressure on the existing rent prices of the existing rental stock.

Where will these projects be located?

Under the Minns Labor Government the new ‘Build to Rent’ program will kick off with $30 million for a pilot program on the South Coast of NSW. The developers, Landcom whom are a large-scale developer in NSW, will identify existing surplus government land to acquire and build low cost housing on. The properties built on this land will be rentals only and be managed by a government agency.

What does this mean for property investors?

Build-to-rent might be a relative new concept, but it’s on an upwards trajectory. Whilst this doesn’t directly affect first home buyer’s ability to purchase, it may impact investors looking to buy an investment property close to a ‘Rent to Buy’ areas because they may find there is less demand for their rental property or downward pressure on rental prices due to the additional supply impacting the cash flow and rental yield of the property.

You may even be an investor who wants to build a ‘rent to buy’ development. If this is the case, you can gain access to the government incentives for land tax as well an additional 10% CGT discount upon sale of the property for providing affordable accommodation meaning you can access the maximum 60% CGT discount.

What are the Government incentives for build-to-rent?

New South Wales

There is a 50% land tax discount in place until 2040 for build-to-rent developments. Build-to-rents can also receive an exemption from foreign investor duty surcharges and land tax surcharges.

Victoria

There is a 50% land tax discount for eligible build-to-rent projects in Victoria. Build-to-rent developers can get an exemption from the absentee owner surcharge for the same period too. The foreign purchaser additional duty can also be waived if certain criteria is met.

South Australia

From 2024, the South Australian government will offer a 50% land tax discount for eligible build-to-rent projects. Further details are to be confirmed.

Queensland

The Queensland government is partnering with several private build-to-rent developments to deliver affordable rental housing through rent subsidies. Ex-gratia relief is available on a case-by-case basis.

If you are looking for a buyer’s agent to assist you with purchasing a home or investment property in the Sydney, Brisbane and Newcastle regions, as well as SA, TAS, ACT, VIC, NSW & QLD please get in touch with Lloyd Edge and his team at Aus Property Professionals here or give us a call on 1800 146 837!