We will discuss here a real-life case study recently completed in Newcastle, NSW to provide you with key educational elements on the importance of a strategy, research, and employing an expert to manage your project.

Strategy

This particular client needed to achieve a large amount of equity in order to advance their investment portfolio and pay off some other debt. They didn’t have the time to invest then sit and wait for the market to increase over the long term.

Due to debts, it was a necessary requirement their portfolio had positive cash flow from day one.

Their maximum available spend for the project was $750,000 (including land, construction, and council costs).

This strategy was the key to why we advised to invest in Newcastle, as well as why the Duplex project was the best recommendation for their portfolio.

Newcastle

Why Newcastle?

After determining their strategy, we knew that Newcastle would be an excellent fit for their project due to the strong rental yields in the area as well as offering excellent value from comparative sales.

There is an extremely high level of government investment infrastructure, particularly the light rail, and expansion of the university’s city campuses. Newcastle is in a great location geographically, with proximity to the harbour and beaches while the CBD is going through a gentrification. The medium house price is still about half that of Sydney so is a lot more affordable as well. This makes Newcastle a highly desirable place to live and invest.

The Trifecta

At the time of entering the project, we knew the Newcastle market was starting to rise but was not yet the hot market which we see today. This meant that at the time of entering the deal we would be able to achieve excellent results which can only be described as “hitting a trifecta in property”- Growth, Cash flow, and Instant Equity.

Suburb Selection

For this particular project, our research pointed us towards West Wallsend, situated 19km from the Newcastle CBD, and in good proximity to the Pacific Motorway and the Hunter Expressway.

West Wallsend has some larger sized blocks suitable for development as well as neighbouring Cameron Park which recently had recently seen major growth in land prices and is a very desirable family suburb.

Our research determined the prices in West Wallsend were substantially lower than its neighbour yet had the potential to receive the ripple effect from Cameron Park.

Planning and Construction

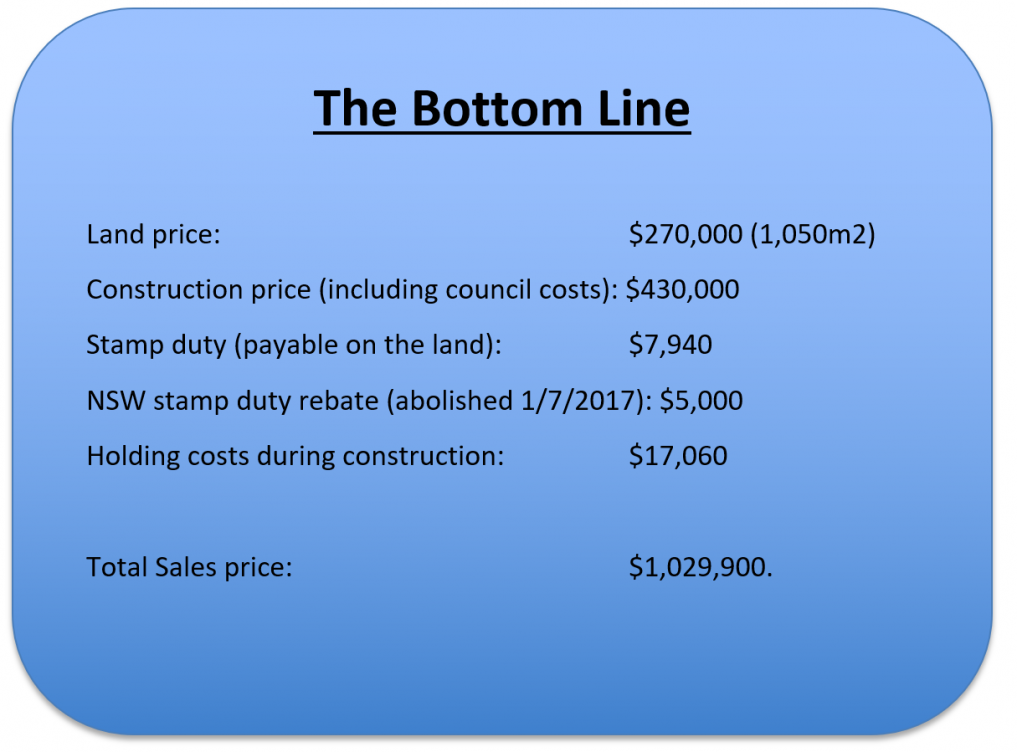

(For the full numbers break down, see below).

We secured a fantastic corner block of 1,050m2 for $270,000. Then our team managed the process to get the Development Application (DA) approved. After a couple of revisions to the floor plan to satisfy council’s assessor, the go-ahead was given to build and we arranged the Construction Certificate which took under 3 weeks. We could then commence on site.

We have built relationships with some very good builders in the area and chose a particular builder which specialises in high quality investment properties.

The total cost of this project was $720,000, keeping under their budget of $750,000 and upholding to their strategy.

Our relationship with the builders meant we secured a few upgraded inclusions for the client, consisting of ducted air conditioning and 2.7mm ceiling heights (standard height is 2.4mm).

This builder prioritised the needs of our client, and completed construction in under 6 months. Given the size of this block, we were able to Torrens title this Duplex for our client which resulted in each unit becoming a separate property, which could be sold separately.

Obtaining Torren’s titles for the units meant their equity potential (if holding) and development profits (if selling) was now supercharged.

Since our client’s strategy was to sell at the end of the project, in order to reinvest funds in another project and to pay off other debt, the units were put for sale on the market for $519,950 and $509,950- respectively. Unit 1 sold for the asking price of $519,950 in under two weeks and currently unit 2 has an offer accepted for the asking price of $509,950. This results in a total sales price of $1,029,900.

These results demonstrate the strength in the Newcastle market and the successful project management of our team.