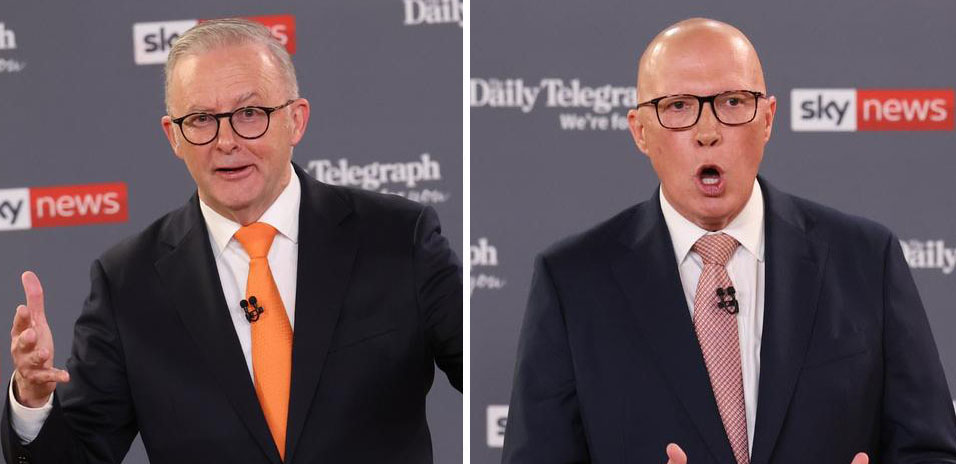

Many property buyers, investors, and sellers were holding on tight until after the 2025 federal election to see the results before making a move in the property markets. Now, post federal election with the Labor government securing a second term, we can analyse how the markets have changed and whether the speculation of policy shifts have impacted Australia’s property markets.

Immediately following the announcement of the federal election, there was a temporary lull in market activity but in the subsequent weeks we saw the property market starting to gain momentum again even as we are entering the typically quieter (winter) months.

How the Labor Government policies can influence buyer and investor sentiment.

Buyer and Investor sentiment has been notably influenced by the Albanese government’s policy initiatives. The introduction of a 20% HECS-HELP debt discount and allowing banks to exclude student debt in mortgage assessments are expected to enhance young buyers’ borrowing power, potentially increasing home prices by 8–15%.

However, these policies have raised concerns among many investors.

Investors with a high superannuation balance are being targeted by the Labor Government with their proposed superannuation tax targeting unrealized gains on balances over $3 million, possibly reduced to $2 million. If this policy comes to light, this could materially impact over 100,000 investors and is likely to expand without inflation adjustments.

Another policy change under fire are the potential changes to capital gains tax, such as reducing the 50% discount on long-term held assets, which will impact investor returns.

Sydney

Sydney’s property market demonstrated notable resilience in the lead-up to the election, with median dwelling prices reaching a new peak of $1,118,000 in April 2025.

The momentum can be attributed to the RBA’s decision to cut interest rates earlier in the year alongside speculation from economists that we are likely to see up to 4 more interest rate cuts this year. (source: NAB Chief Economist, Sally Auld).

The speculation of further rate cuts only adds ‘fuel to the fire’ as buyers want to purchase before the market really takes off. As history shows us, a reduction in interest rates will spark more buyer activity and property prices start to rapidly increase.

The supply constraints are evident, particularly in Western Sydney where building and construction has only produced just 22.5% of its annual housing needs, a shortfall that is common amongst high demand, family orientated regions.

To further appease property buyers, the labor government will reintroduce the First Home Guarantee Policy (effective 1 January, 2026), which allows first-time buyers to purchase homes with a 5% deposit given that you meet certain criteria and qualify.

However, this policy will have an adverse effect of driving prices up further in the price range of many first home buyers as this portion of the market becomes more competitive with the increased demand.

Melbourne

In the week following Labor’s decisive May 3, 2025, election victory, auction clearance rates in Melbourne surged to 74.4%—the highest in two years. Melbourne has recorded the biggest acceleration in property prices of any capital so far this year (as of April 2025).

PropTrack’s March Home Price Index revealed the city’s home values rose by 0.7 percentage points in the first quarter of 2025 after falling 1.3 percentage points in the December quarter— the fastest acceleration in property prices nationwide.

But when we reflect on the rolling 12 months to March 2025, Melbourne’s median dwelling price fell by 2.26%, making Melbourne the only city with negative annual price growth. (source: PropTrack).

This positions Melbourne in a prime position for investors to take advantage of the under-priced properties as Melbourne is potentially on their rebound from the bottom of their property cycle.

Melbourne took a massive hit to the property market after the Victorian State Government took extreme and drastic measures during the COVID years. However, with the past behind us we are seeing buyers’ enthusiasm come back towards buying in Melbourne. This rebound has come off the back of improved consumer sentiment, easing living costs, and stable labor markets and we are expecting the moderate gains in the Melbourne property markets to continue.

Brisbane

Brisbane has been closely watched by investors because they are hosting the 2032 Olympics which brings with it a lot of infrastructure spending and improvements. However, April 2025 presented a much quieter period, with activity easing off due to school holidays, the Easter long weekend, and the lead-up to the federal election.

Now we are post-election, the landscape in Brisbane is presenting many opportunities for growth.

Brisbane is expected to benefit from policies presented from the Federal Government, and expanded homebuyer support schemes are likely to further bolster demand in a market where affordability remains a concern. Many experts are expecting Brisbane’s property market to maintain a moderate growth trajectory in 2025, particularly with the ongoing undersupply of housing continuing to exert upward pressure on home values.

Infrastructure spend plays a very important role in shaping property market trends, if you look further in QLD to the Sunshine Coast, we have seen a surge in property interest following the completion of the $1.8 billion Bruce Highway upgrade. This project not only improved connectivity to Brisbane but also enhanced the region’s appeal for remote workers and lifestyle-driven buyers.

Looking Ahead, Market Outlook for 2025

As we progress through 2025, the property markets are expected to go through a period of adjustment and growth. The re-election of the Albanese government and the introduction of supportive policies for first-time buyers will drive demand, particularly in the lower to mid-price range of the markets. The present challenges will continue of affordability constraints, housing supply issues, and the threat of changes to taxation policies. Policies targeting capital gains, superannuation, alongside the constant speculation of changes to negative gearing benefits will always be back of mind for investors and they will tread with caution.

In Sydney, the combination of policy initiatives and sustained demand is expected to drive price growth, particularly in the markets favoured by first-home buyers. Melbourne’s market is prime for investors and there is anticipation we will see Melbourne gradually recovery. Brisbane’s property market is poised for moderate growth, bolstered by policy tailwinds and ongoing undersupply with the Olympics boosting investor sentiment.

The federal election has brought to the forefront the importance of staying informed about policy developments and key market trends. If you are thorough with your market research, will find valuable opportunities in the post-election markets.

****

Thank you for reading our blog on Australia’s Post-Election Property Market. Make sure you head over to our YouTube channel by clicking here to discover more educational insights to level up your property investing including our latest video: Australian Property Market 2025 Forecast.

Disclaimer:

Aus Property Professionals Pty Ltd retains the copyright in relation to all the information contained on its website and in this guide. This guide, and any content provided in addition, or linked to resources, is general information only and not investment advice. As everyone’s individual situation is different, we advise individuals to always seek advice from relevant professionals such as legal, financial, accounting, and investing experts.

The intention of this guide is to be used for general information purposes only, in addition to your personal research and due diligence. We do not take any responsibility for any actions taken as a result of this guide as any actions should always be taken with consultation with relevant professionals who take individual circumstances to account.

Past performance doesn’t guarantee future results.

We have compiled the information contained in this guide from online resources, our research, and consultations, and we cannot guarantee the complete accuracy of this information, and we will always reference the resources where the data and information was derived.